Identifying Live Players Who Outperform the Stock Market

Four years of data show the stock price performance of publicly-traded companies after they are profiled in Bismarck Brief. Live player companies outperformed by far.

A few weeks ago, we issued the 200th Bismarck Brief. This is the third year we can evaluate the Briefs like a data set of their own, allowing us, to a degree, to evaluate our own analytic performance. One interesting and easily-answered question is: what happens to the stock prices of publicly-traded companies after they are profiled in Bismarck Brief?

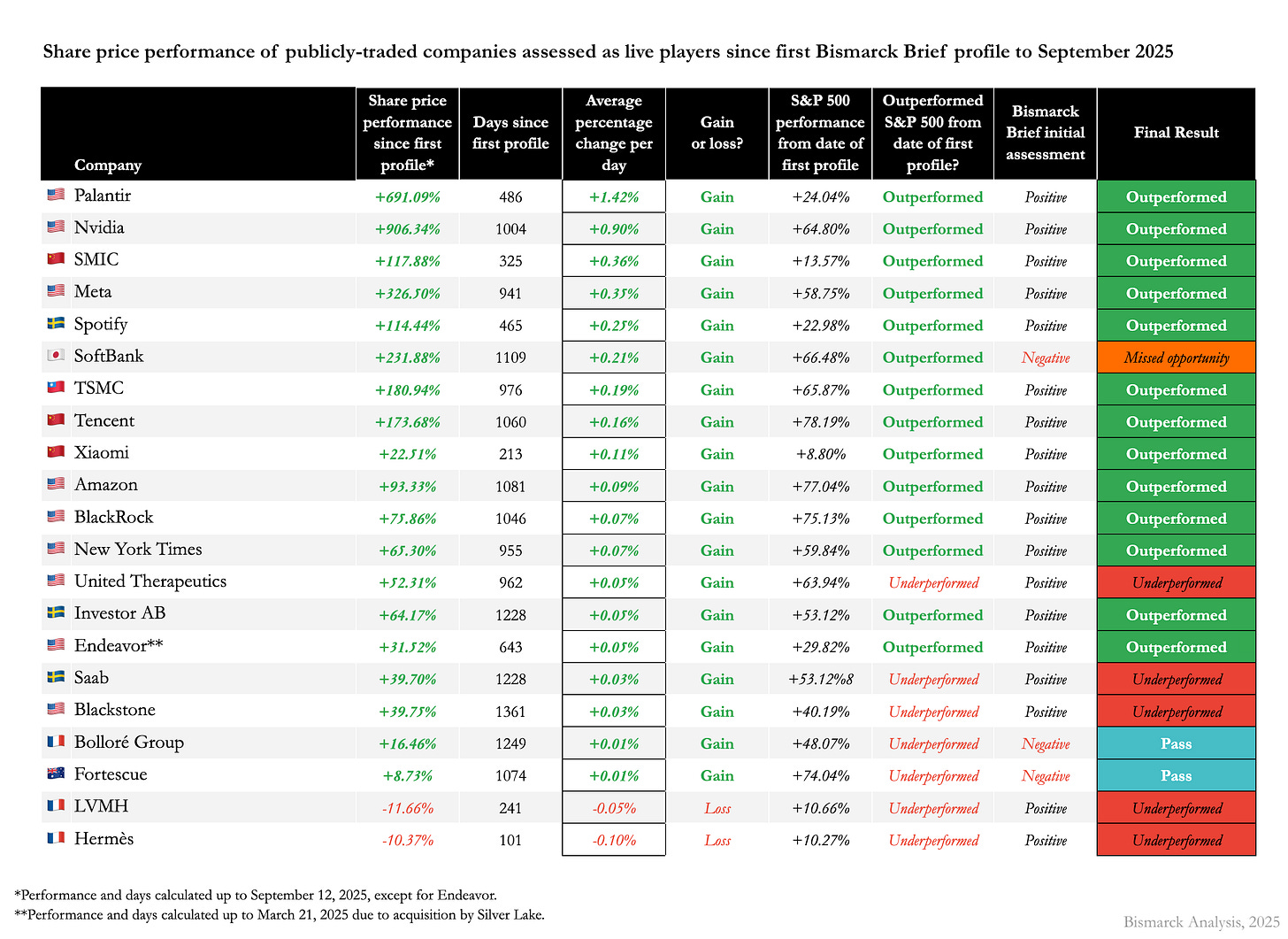

Above is a graph of the share price performance of every publicly-traded company covered in Bismarck Brief since the date it was covered to September 12, 2025. Bismarck Brief is not financial or investment advice (see full disclaimer below).1 But, generally, a positive assessment of institutional functionality or live player strategy in the context of business will eventually be reflected by the wider markets as well, as the fruits of such functionality become widely recognized.

If one had invested the same amount of funds into each company that Bismarck Brief positively assessed on the date the corresponding Brief was published, one would have invested 41 times and the total investment would have grown by +88%. Had one instead invested into the S&P 500 the same number of times on those same dates, it would have grown only +40%, less than half the return. Had one taken the same total amount of invested funds and instead put them into the S&P 500 all at once when Bismarck Brief began publishing, then left them alone, the total investment also would have grown only +40%.

The most striking empirical outcome, however, is that if one had invested the same amount of funds only into the 21 publicly-traded companies Bismarck Brief evaluated specifically as live players, one’s total investment would have grown a staggering +157%, compared to just +48% for the equivalent investments into the S&P 500. Such figures suggest the attentive Brief reader is well upstream of the passive market investor.

The Brief only evaluates institutions that are plausibly strategically important, so the decision to profile a company at all means it is worth attention, whether or not its valuation subsequently grows or declines. If one had invested the same amount of funds into each company Bismarck Brief covered, whether positive or negative, one would have invested 57 times and the total investment would have grown by +74%, compared to +40% for the equivalent investments into the S&P 500.

Every investment strategy is necessarily far more idiosyncratic and developed in practice than this simple thought experiment. But this shows that Bismarck Brief can provide a unique and useful perspective for investors that is upstream of markets, even though our focus is exclusively on investigating the structures of institutions and strategies of live players.

Bismarck Brief wrote and issued in-depth investigations of multiple of the best-performing publicly-traded companies of recent years immediately prior to meteoric rises in their stock prices. Our Brief on Nvidia was sent to our paid subscribers on December 14, 2022. Since then, Nvidia’s share price has grown an incredible +906%. Our Brief on Palantir was sent on May 15, 2024. Since then, Palantir’s share price has grown +691%—in just over a year. Our Brief on Meta was sent on February 15, 2023. Since then, Meta’s share price has grown +326%. Bismarck Brief was prescient on other top performers like TSMC, Tencent, Broadcom, Spotify, and others. Once is a fluke. Twice is a coincidence. But three or more times is the indication of valuable knowledge.

Nvidia is a positive outlier. But so was the Brief’s exceptionally positive assessment of Nvidia’s technological leadership. The Brief concluded:

[...] insofar as the computationally intensive deep learning model of AI is the most promising to usher in an AI revolution in technology and industry, Nvidia is one of the most promising companies poised to benefit from it.

Jensen Huang has shown an ability to undertake long-term, highly risky changes in strategy and achieve a massive payoff that places Nvidia at the center of a very promising market and justifies its enormous valuation. Increased governmental constraints through antitrust and export controls constrain Nvidia’s future vertical integration, but should not hinder its expansion based on its current model, so long as demand for powerful GPUs and other chips continues to increase. Nvidia’s enviable position is leading many would-be competitors to challenge it, but so long as Jensen Huang proves to be a live player while in charge of the company, Nvidia will probably be capable of weathering any competition, whether by simply outcompeting established giants or buying out small startup challengers.

Similarly, the Brief was exceptionally positive about another positive outlier, Palantir, concluding that:

Under Karp, Palantir has been a live player. At 56 years old, Karp is unlikely to leave the company anytime soon, but is rather in the midst of a years-long and successful strategy to grow the company’s commercial client base under “unrelenting demand,” in Karp’s own words. In 2018, Palantir hired its first-ever salespeople and Karp described the company as “going into adolescence.” In the fourth quarter of 2023, Palantir reported a profit for the first time. The company is likely to derive more revenue from commercial clients rather than government ones for the first time ever in the next few years. For both types of clients, Palantir’s provision of fundamental organizational and decision-making software, as well as the necessary expertise to maintain or update it, means that Palantir will, over time, become a difficult-to-displace incumbent that benefits from institutional inertia. So long as Palantir itself remains lean and maintains its unique brand, this will also likely result in high margins.

Many have an instinctive resistance to the idea that the greatest financial returns accrue from just a few bets that, years down the line, become perceived as obvious in hindsight. There is a sense that it couldn’t be, or shouldn’t be, so simple. Yet careful observers of both startups and stock markets have long known that the most outsized financial returns always come from just a tiny few paradigm-shifting companies led by live players. It was not luck that determined that Bismarck Brief would investigate Nvidia or Palantir before these companies captured the attention of the world’s investors, but our methodical investigation of the organizations making the world’s most dazzling technological advances possible.

Day in and day out, the team behind Bismarck Brief tirelessly searches for the world’s most technologically and strategically impactful companies, and the live players behind them. I warmly invite those who wish to know the results of our search, in detail and every Wednesday at 2pm GMT sharp, to become paid subscribers today:

All but two of the 21 companies assessed to be live players by Bismarck Brief saw their stock gain value since their first coverage in a Brief. The two that have seen losses were both profiled less than one full calendar year ago and have seen just minor losses so far. Perhaps surprisingly, U.S. companies were a minority of the companies assessed to be live players, with the rest hailing from China, Taiwan, Japan, Sweden, and France. These non-U.S. companies are unlikely to have been brought to the attention of someone who was not an attentive Bismarck Brief reader.

A full two-thirds of companies assessed to be live players not just gained in value but outperformed an equivalent investment into the S&P 500 on the same date they were profiled. Of the seven that underperformed, two are the aforementioned companies profiled less than a year ago, two were apparently correctly negatively assessed by the Brief, and the other three have all significantly gained in value, but just somewhat less than the S&P 500 since the same date. Only one live player that outperformed was apparently incorrectly negatively assessed by the Brief.

It is perhaps a reminder never to bet against a determined live player, who will figure out a novel way to turn fortunes around where a dead player would instead accept its fate as determined by the distributed consensus of passive investors. But the market itself is a dead player, whose expectations are routinely surprised and outmaneuvered by live players. Returns come not from aligning with the consensus of passive investors, but by aligning with live players who successfully change that consensus.

Compared to when we performed the same analyses of stock price performance in 2023 and 2024, Bismarck Brief has not just consistently outperformed, but performed better and better every year. In 2024, we found that the returns on positively-assessed companies were 1.7x greater than the returns on equivalent investments on the same dates into the S&P 500, while in 2025, they were 2.2x greater. Meanwhile, live player returns have grown from being 3.4x greater to being 3.9x greater.

Bismarck Brief is not financial advice. It is not intended to be, nor will it ever be. The Brief researches and analyzes the fundamentals of institutional structure, leadership, and strategy, sometimes for publicly-traded companies, but also for every other kind of key institution, whether it is a private company, government bureaucracy, nonprofit foundation, defense contractor, media outlet, microstate, or something else. Markets do not care about fundamentals themselves. The valuations of public companies are driven rather by the capricious swings in the collective moods of retail and also institutional investors—the widespread adoption of metrics like ESG demonstrates that political considerations play a significant role as well.

The methodical and careful application of our unique theory can nevertheless help investors ground intuitions and set expectations of the future. The legendary investor George Soros famously viewed his investing strategy as popping the epistemic bubbles of false but widespread beliefs. Such a feat necessarily requires the unique knowledge, social information, and final judgment of an individual investor. But to evaluate a belief as false, one must first have a solid grounding in true fundamentals. In this way, Bismarck Brief can crucially help investors, much in the same way as it provides a strategic perspective to companies, philanthropists, and governments.

If you are not already a paid subscriber to Bismarck Brief, I warmly invite you to subscribe today and join us on this ongoing investigation into the global power landscape:

In recent months, Brief subscribers have received in-depth investigations of publicly-traded companies including Oracle, BYD, Honda, Northrop Grumman, Hermès, Reliance Industries, and more. They have also received Briefs on the leading artificial intelligence labs DeepSeek, Mistral, and Moonshot AI, as part of our upcoming AI 2026 report, which will feature in-depth analysis of the state of the AI sector and technology with comprehensive profiles of key players. In the coming months, subscribers can expect Briefs on companies including Microsoft, Google, OpenAI, xAI, Anthropic, Berkshire Hathaway, Blue Origin, Carl Zeiss, and much more.

Sincerely,

Samo Burja

Founder and President, Bismarck Analysis

Disclaimer: Bismarck Brief does not offer financial or investment advice. This content is for informational purposes only and should not be construed as professional financial, investment, or other advice. All content is of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this site constitutes professional, financial, or investment advice. Bismarck Analysis is not a fiduciary by virtue of any person’s use or access to Bismarck Brief or this content. Investing in securities carries the risk of losing funds.